irs tax levy letter

For example if you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. It is different from a lien while a lien makes a claim to your assets as.

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

A lien is a legal claim against property to secure payment of the tax debt while a.

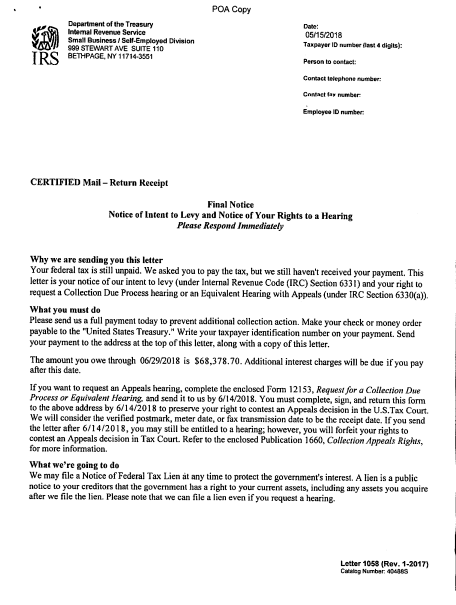

. The CP15 notice is not an IRS Tax Levy but instead a Notice of Penalty and the first rung of the IRS tax levy ladder. This letter is required by IRC 6331 before the IRS issues a levy unless collection is in jeopardy to collect tax from most sources. The first is to file IRS Form 12153 which is the Request for Collection Due Process or Equivalent Hearing.

The notice may tell you that the IRS plans. If you do not agree. To appeal there are two main methods.

Even if you think you do not owe the tax bill you should contact the IRS. You paid the amount you owe and no longer have a balance. This letter is to notify you the IRS filed a notice of tax lien for the unpaid taxes.

Letter 3172 Notice of Federal Tax Lien Filing and Your Rights to a Hearing under IRC 6320. The IRS is required to release a levy if it determines that. A levy is a legal seizure of your property to satisfy a tax debt.

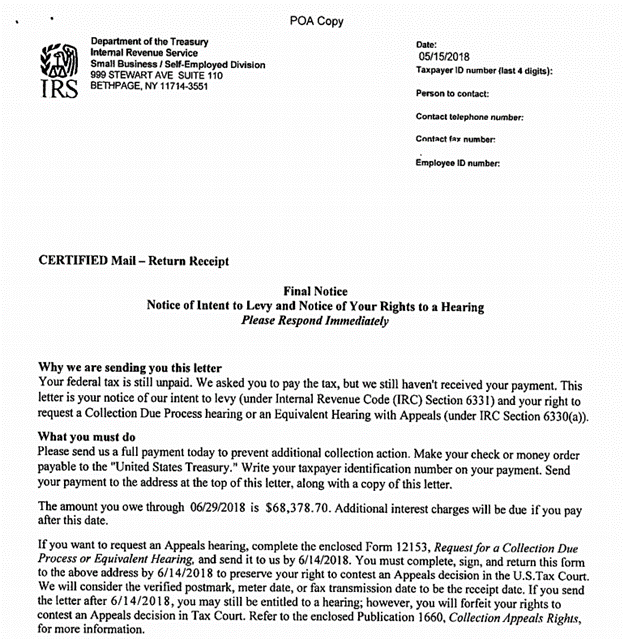

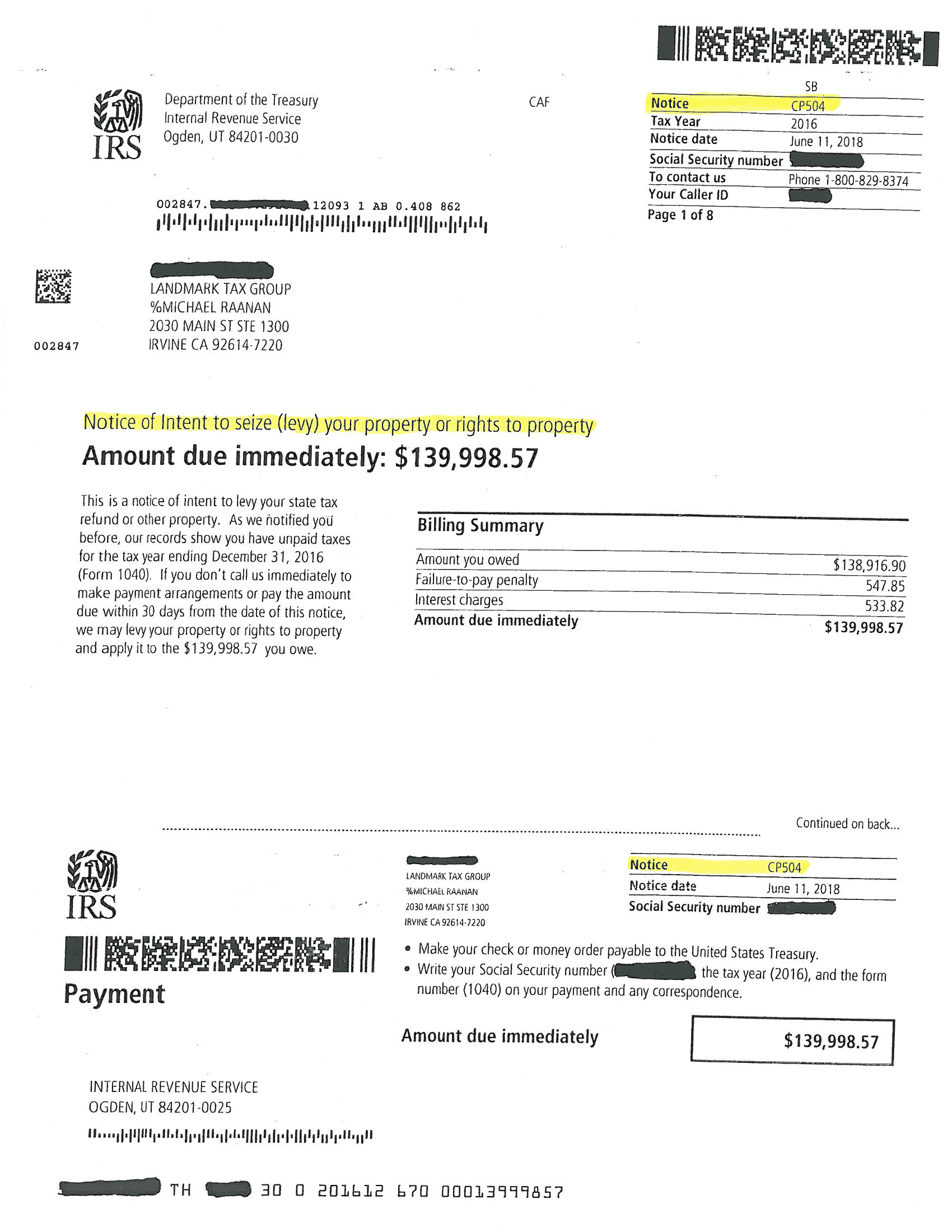

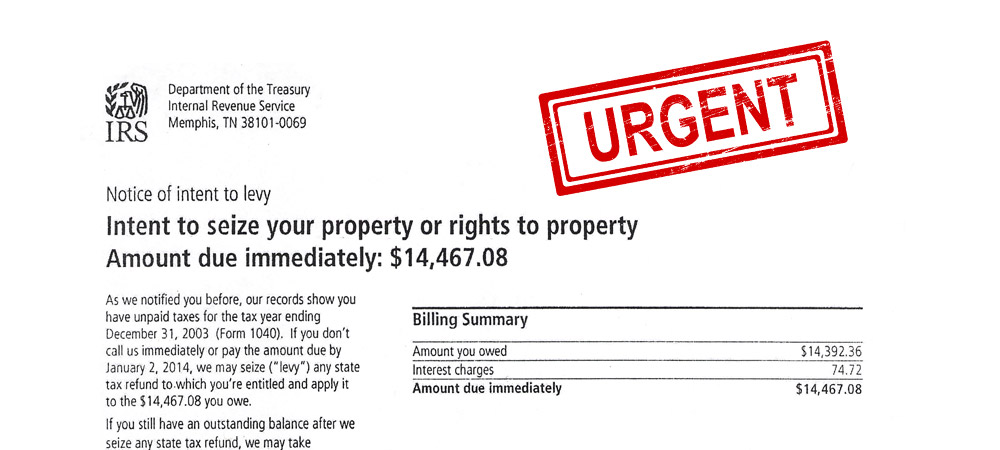

The IRS notifies you of its intent to levy by. CP504 Penalty Notice and Tax Levy Warning. For a Notice of Federal Tax Lien you have likely received.

The first thing to do is to check the return address to be sure its from the Internal Revenue Service and not another agency. Levies are different from liens. This is the letter you receive before the IRS levies your assets.

A notice of levy from IRS is also called an IRS notice of intent to seize your property. Federal tax levies have priority over all other liens with the exception of child support. Quite frankly the CP504.

The IRS is notifying the delinquent taxpayer that they will begin. The period the IRS can collect the tax ended before the levy. If the levy is from the IRS and your property or.

This letter hereby notifies you that we have received an IRS Tax Levy to withhold from your wages. It is different from a lien while a lien makes a claim to. The IRS is required to notify you again prior to levy whenever any new ie additional tax assessments are applied to your IRS account.

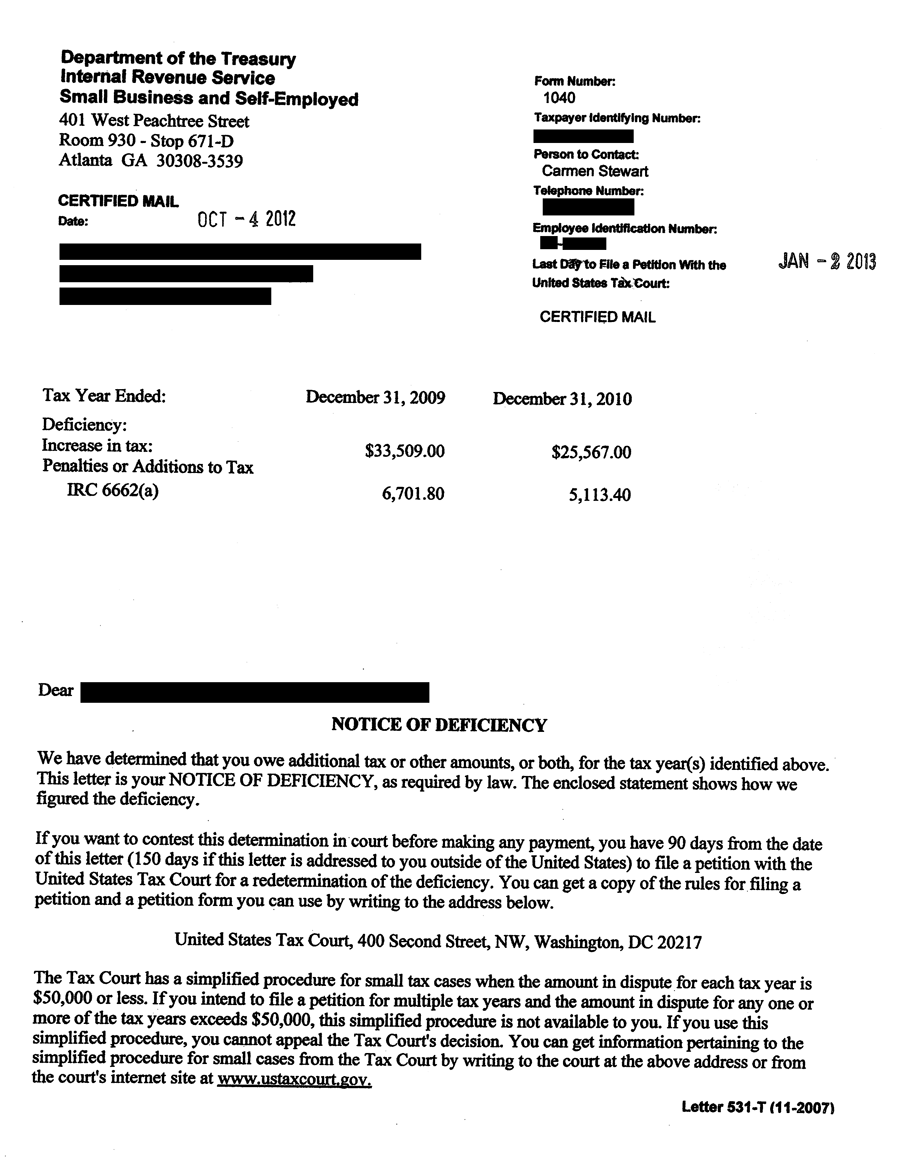

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing. An IRS Notice of Levy is a letter sent to taxpayers who have not paid their back taxes and have an IRS lien placed against them. For a Notice of Deficiency you have likely received either a Letter 3219 Letter 3219N Letter 950DO or Letter 1862.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. How to Appeal a Tax Levy. Taxpayers are not entitled to a pre-levy hearing.

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

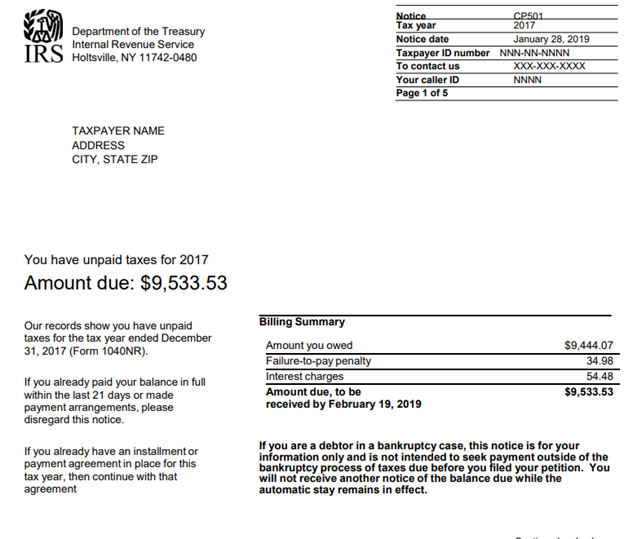

Irs Notice Cp504 Understanding Irs Notice Cp504 Notice Of Intent To Levy Immediate Response Required

Irs Cp504 Tax Notice What Is It Landmark Tax Group

Irs Just Sent Me A Notice Of Intent To Seize Levy Your Property Or Right To Property Cp 504 What Should I Do Legacy Tax Resolution Services

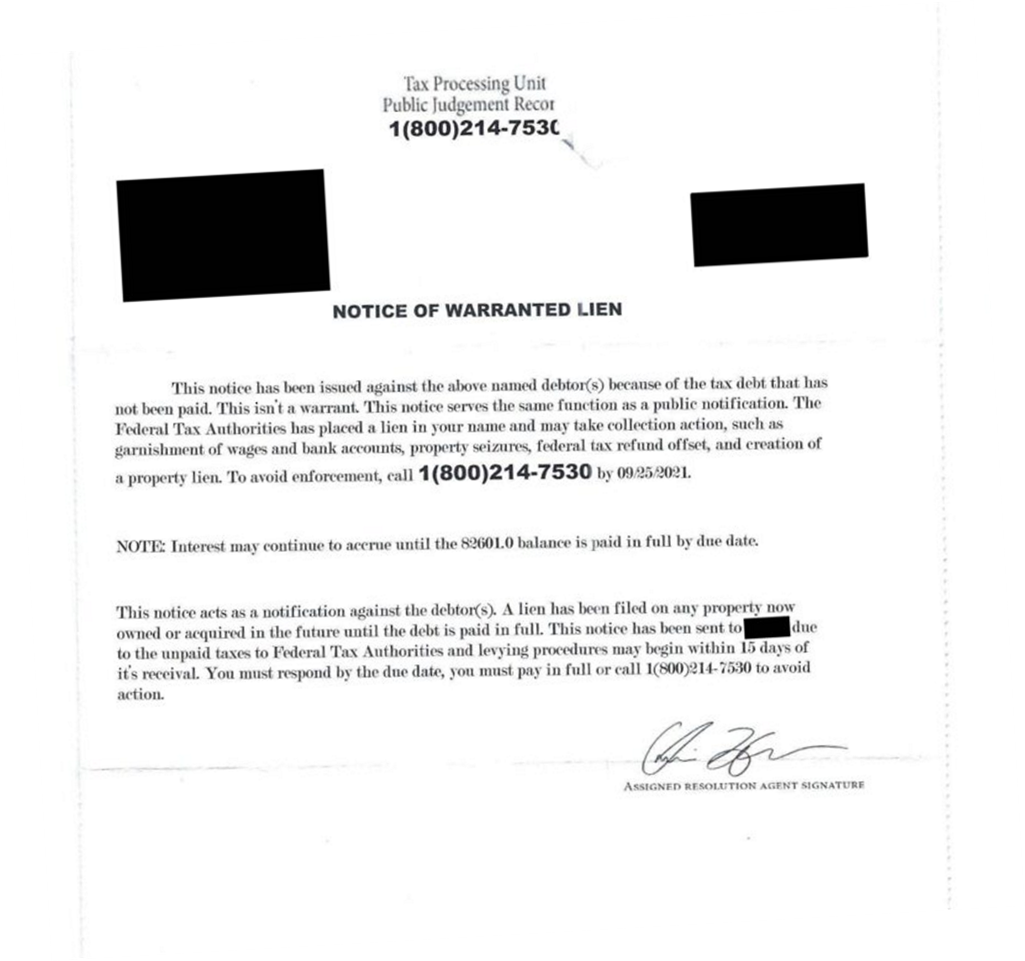

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

Offer In Compromise Scams Expected To Increase

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Notices And Irs Letters Has The Irs Contacted You Protect Assets From Seizure

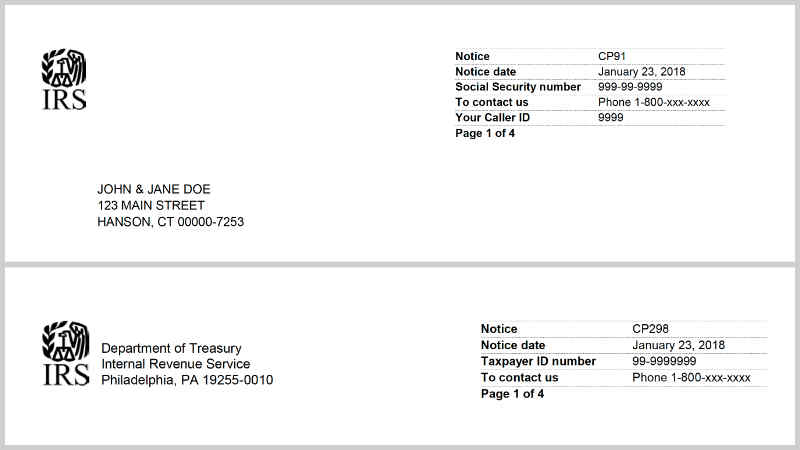

Notice Cp 91 298 Final Notice Before Levy Of Social Security Benefits Tax Defense Group

Irs Letter 1058 The Final Notice Of Intent To Levy Tax Financial Planning Cpa Firm

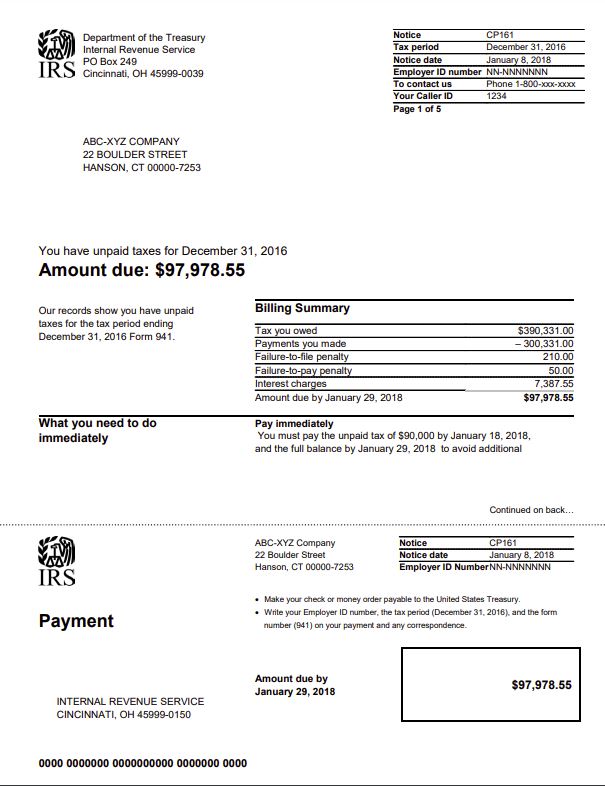

Irs Audit Letter Cp504 Sample 1

New Taxpayer Scam Fake Irs Letters Alfano Company Llc

Tax Resolution Mendoza Company Inc

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Irs Audit Letter Cp518 Sample 1

How To Release An Irs Levy Remove Federal Tax Levy

The Irs Sent You A Final Notice Of Intent To Levy And Notice Of Your Right To A Hearing What Should You Do Now Brandon A Keim Phoenix Tax Attorney

Tax Letters Washington Tax Services

Did You Receive Irs Notice Lt16 What You Need To Do To Prevent An Irs Levy Tax Attorney Orange County Ca Kahn Tax Law